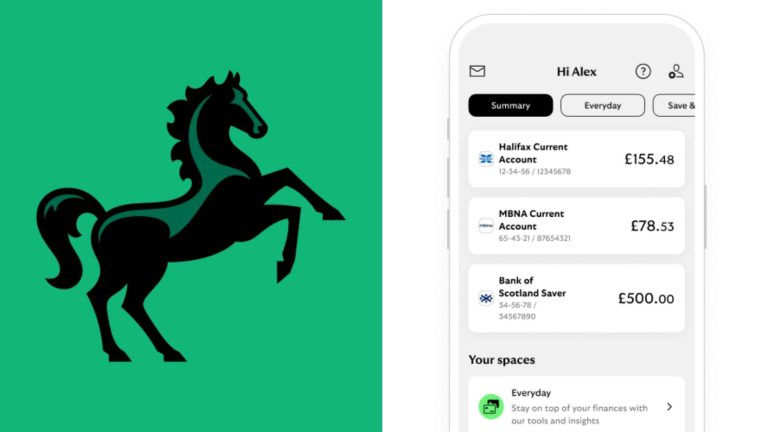

As Britain’s students prepare for the new academic year, the Lloyds banking app takes centre stage today with the launch of an enticing student account offer, marking August 1, 2025, as a significant date for the UK’s digital banking landscape.

New Student Account Goes Live Today

Starting today, students across Britain can access Lloyds Bank’s latest student current account offering through the Lloyds banking app, which promises £100 in cash alongside £90 worth of Deliveroo vouchers. The timing couldn’t be more strategic, arriving just as thousands of prospective university students begin their financial preparations for the upcoming academic year.

The new account, accessible via the Lloyds banking app, offers students who pay in at least £500 between today and October 31, 2025, a substantial welcome package. Beyond the immediate cash incentive, students receive £15 monthly in Deliveroo vouchers for their first six months – a clear nod to the takeaway culture that dominates university life.

Digital-First Banking for the Next Generation

The Lloyds banking app serves as the primary gateway for these new student accounts, reflecting the bank’s commitment to mobile-first banking. With features specifically designed for student life, the app includes subscription management tools – particularly valuable for managing the streaming services and gym memberships that often catch students off guard financially.

Research suggests that students increasingly favour digital solutions, with the Lloyds banking app positioned to capture this demographic through its comprehensive mobile banking platform. The app allows students to manage their entire financial ecosystem from their phones, from checking balances to setting spending limits and tracking subscriptions.

Enhanced App Features for Student Life

Today’s launch showcases several Lloyds banking app features particularly relevant to student customers. The subscription management tool enables users to view, cancel, or block regular payments – addressing the common student challenge of forgotten free trials that turn into unwanted monthly charges.

The app also provides real-time spending insights, helping students understand where their money goes each month. With features like Save the Change, which rounds up debit card purchases to save spare change automatically, the Lloyds banking app aims to encourage positive financial habits from the start of students’ independent financial journeys.

Recent Technical Improvements Following July Outages

Today’s student account launch comes after the Lloyds banking app experienced significant outages in late July 2025, affecting thousands of customers during payday. The timing of today’s launch suggests the bank has resolved those technical issues and is confident in its app’s stability as it targets new student customers.

The July outages highlighted the critical importance of app reliability, particularly when customers depend on mobile banking for essential transactions. With students increasingly relying on digital banking, the Lloyds banking app team has likely implemented additional stability measures ahead of today’s launch.

Competitive Student Banking Landscape

The Lloyds banking app enters a fiercely competitive student banking market today. Rival banks offer similar perks, with NatWest providing £85 cash plus a four-year Tastecard membership, while Nationwide offers £100 cash alongside £120 in Just Eat vouchers.

However, Lloyds differentiates itself through its comprehensive mobile banking platform. The Lloyds banking app serves over 20 million active mobile users, providing the infrastructure and experience that could prove decisive for tech-savvy students.

Broader Banking App Trends

Today’s launch reflects broader trends in UK digital banking, where mobile apps have become the primary interface between banks and customers. Recent data shows that searches for banking apps have surged by 29% in the past year, with younger demographics leading this digital adoption.

The Lloyds app has positioned itself at the forefront of this trend, offering everything from travel booking services to investment management within a single platform. For students, this comprehensive approach means they can grow with the app as their financial needs become more complex.

App Maintenance and Improvements

Notably, the Lloyds banking app has scheduled maintenance work for Saturday, August 2, from 12:30 AM to 3:00 AM, during which international money transfer services will be temporarily unavailable. This planned maintenance suggests ongoing efforts to improve app performance and reliability.

The timing of this maintenance, just one day after the student account launch, indicates careful planning to minimise disruption while ensuring optimal app performance for new student customers.

Student Financial Management in the Digital Age

As today marks the beginning of Lloyds’ student recruitment drive, the Lloyds banking app represents more than just a digital banking platform – it’s becoming a comprehensive financial management tool for the next generation. With features ranging from credit score monitoring to investment options all accessible through mobile devices, students can manage increasingly complex financial lives through a single app.

The £90 worth of Deliveroo vouchers, delivered through the Lloyds banking app, acknowledges the reality of modern student life, where convenience and digital integration are paramount. This practical approach to student banking suggests Lloyds understands its target demographic’s preferences and lifestyle choices.

The Significance of Today’s Launch

August 1, 2025, represents a strategic milestone for the Lloyds banking app as it actively courts the next generation of banking customers. With student debt concerns mounting and cost-of-living pressures affecting young people disproportionately, the combination of immediate cash incentives and practical app features addresses real student financial challenges.

The launch also demonstrates how the Lloyds apps continue evolving beyond traditional banking, incorporating lifestyle elements like food delivery vouchers that resonate with target demographics. This holistic approach to financial services reflects the changing expectations of digital-native customers.

As students across Britain begin their university preparations today, the Lloyds banking app positions itself not just as a banking tool, but as a financial companion for the next phase of their lives. Whether this strategy succeeds will depend mainly on the app’s ability to deliver consistent, reliable service – particularly crucial following recent technical challenges.

For now, August 1, 2025, marks a significant moment in UK student banking, with the Lloyds app leading the charge into a new academic year with fresh offerings designed for Britain’s digitally-minded student population.

Read More: Click Here